ボブ ピンクアッシュ (263 無料写真)

ピンクアッシュ_外ハネボブアッシュブラウンネオウルフ_ba251151:L048482285|アルバム 新宿ALBUM SHINJUKUのヘアカタログ|ホットペッパービューティー。

最大73%OFFクーポン ピンクアッシュちゃん額縁 sdspanama.com。

市販】ピンクアッシュ×セルフカラー剤5選|仕上がり〜色落ちまで《ブリーチなし・あり》別に| HAIRLIE PRESS[ヘアリープレス]。

人気ピンクはアッシュ×グラデーションに注目。暗め・明るめ、どっちに挑戦する?|MERY。

毎日がバーゲンセール ウィッグ ボブ ストレート アッシュ ピンク グラデーション divicamp.com.br。

ウィッグ ボブ ショート フルウィッグ ピンクアッシュ 通販 parelhas.rn.gov.br。

ピンクアッシュは色落ちもかわいい♡ブリーチなし あり別に過程を解説♡| HAIRLIE PRESS[ヘアリープレス]。

ハスキーピンク×ショートボブ reve STYLE GALLERY。

W24☆インナーカラー入り ストレートボブ アッシュピンク 可愛い☆ エクステ www.inclusiveminds.in。

ピンクアッシュヘア】の魅力を徹底解説!フェミニン × アンニュイで大人かわいく|MINE(マイン)。

ピンクアッシュは甘くなりすぎない!トーン・レングス別にご紹介!色落ち対策も bangs [バングス]。

岐阜の美容院・美容室 シェリッシュノース|ラベンダーピンクアッシュ♡。

髪色図鑑】ピンクアッシュってどんな髪色?厳選ヘアカタログ31選を紹介 minimo room。

アッシュ系orピンク系?人気【ボブ×グラデーションカラー】を調査 ARINE [アリネ]。

ピンクアッシュ_ba302351|ALBUM GINZA所属・ALBUM 銀座店のヘアカタログ20210105121715|ミニモ。

インナーカラーピンク】デザイン写真30選!きっとお気に入りが見つかるよ。 石川県 金沢市 片町 タテマチ 諸江 野々市 横川|美容室 美容院|4cm ヨンセンチメートル。

淡めピンク系カラーで、楽しめるカラーに!!! ヘアカタログ ボブ, ヘアスタイル, ボブ パーマ 40代。

ba2259透明感ピンクアッシュインナーカラー切りっぱなしボブ:L038503329|ベレーザ 渋谷BELEZAのヘアカタログ|ホットペッパービューティー 髪色 ピンク, ヘアカラー ピンク, 髪 カラーリング。

行きたい時に行けるサロン|【公式】 B's amor 春日井神領店。

ピンクアッシュ×ショートボブ☆ダブルカラー:L171997507|グランドール リュクスGrandoll Luxeのヘアカタログ|ホットペッパービューティー。

ピンクアッシュは甘くなりすぎない!トーン・レングス別にご紹介!色落ち対策も bangs [バングス]。

2023年秋】ショート ピンクアッシュの髪型・ヘアアレンジ|人気順|ホットペッパービューティー ヘアスタイル・ヘアカタログ。

サロンワークカラー。淡いピンクアッシュ 下北沢のブリーチが得意な美容室、美容院【HONEY MUSTARD】(ハニーマスタード)。

透明感ピンクアッシュ×伸ばしかけショートボブ:L181253948|リースリーRe.3 connecting beautyのヘアカタログ|ホットペッパービューティー。

2021春夏ヘアカラー】イノアピンクアッシュ×切りっぱなしミディアムボブ。

ブリーチなしピンクアッシュ】34mmコテをあわせたミディアムラフウェーブ。

テフリ ショートボブ ウィッグ ピンクアッシュ ブランド品専門の www.shelburnefalls.com。

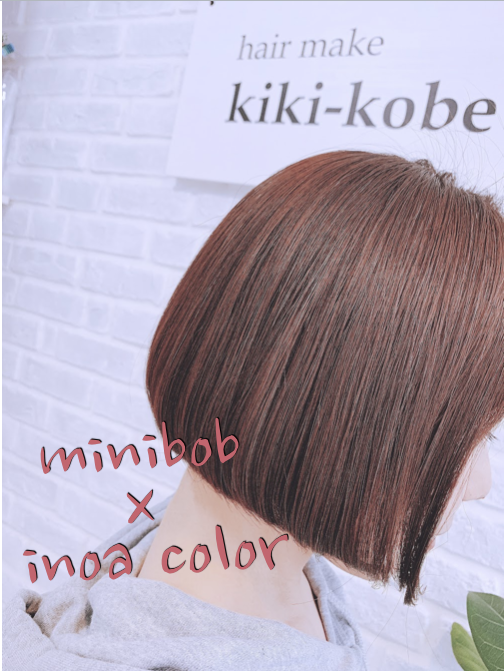

ボブ】ミニボブ ピンクアッシュ letonの髪型・ヘアスタイル・ヘアカタログ|2023夏 秋。

ピンクアッシュってどんな髪色?色味の特徴と2023年版ヘアカラーサンプル集|ホットペッパービューティーマガジン。

ピンクアッシュ×グラデーション》旬のモテカラーでアカ抜け大変身!|MINE(マイン)。

ピンクアッシュヘア】の魅力を徹底解説!フェミニン × アンニュイで大人かわいく|MINE(マイン)。

ピンクベージュ ピンクアッシュ ハイトーンボブ ボブピンク ピンクカラー ヘアカラー ホワイトピンク ピンク Hair designs, Long hair styles, Hair styles。

ピンクアッシュってどんな髪色?色味の特徴と2023年版ヘアカラーサンプル集|ホットペッパービューティーマガジン。

大人女性のピンクアッシュボブ〜 福岡 オーガニックカラー miroaフクオカ ミロアのヘアスタイル 美容院・美容室を予約するなら楽天ビューティ。

ピンクアッシュボブ さんかく美容室サンカクビヨウシツのヘアスタイル 美容院・美容室を予約するなら楽天ビューティ。

新品 ミディアム カール ウィッグ ピンクアッシュ ボブ 内巻き フルウィッグ 【楽ギフ_のし宛書】 1428円 www.institutojesue.org.br。

暗めでもかわいい!ブリーチなしのピンクアッシュヘアカタログ! ARINE [アリネ]。

ヘアカラーはピンクアッシュで旬ガール♡グラデーションで差をつけよ ARINE [アリネ]。

切りっぱなしボブ×ピンクアッシュ|PAUSE所属・大久保 希のヘアカタログ20190611132233|ミニモ。

以下でより多くの画像をご覧ください:

ボブ ピンクアッシュ

![隠れピンクで恋愛運up?】モテを狙えるピンクヘアカラーがツボ♡ ARINE [アリネ]](https://transnet-ir-2019.co.za/img/ab4e47772cec14013011119f723d7be6.jpg)

![ピンクアッシュってどんな色?おすすめの髪色15選【明るめ・暗めのオシャレなヘアカラーを紹介】| LALA [ララ]](https://transnet-ir-2019.co.za/img/9e6b6d71c9807d5f659983f860189341.jpg)

![ヘアカラーはピンクアッシュで旬ガール♡グラデーションで差をつけよ ARINE [アリネ]](https://transnet-ir-2019.co.za/img/233727.jpg)

![2023年夏】ピンクアッシュの髪色・ヘアカラー|LALA [ララ]ヘアカタログ](https://transnet-ir-2019.co.za/img/c6e8453554af617575696ca56121782e.jpg)

![ピンクアッシュは甘くなりすぎない!トーン・レングス別にご紹介!色落ち対策も bangs [バングス]](https://transnet-ir-2019.co.za/img/dda9897d580ca76389eeac6d6b70d2c0.jpg)

![ピンクアッシュってどんな色?おすすめの髪色15選【明るめ・暗めのオシャレなヘアカラーを紹介】| LALA [ララ]](https://transnet-ir-2019.co.za/img/31906a4f745ca705c17cb172d376c60d.jpg)

![アッシュ系orピンク系?人気【ボブ×グラデーションカラー】を調査 ARINE [アリネ]](https://transnet-ir-2019.co.za/img/748541.jpeg)